Fixed Rate Home Loan Expiring Soon?

What is a fixed rate home loan? A fixed rate home loan is an interest rate on your home loan rate for a set period of time. This means that your loan repayments will not increase or decrease if the home loan interest rate market changes. During the Covid19 pandemic and soon after, fixed rate […]

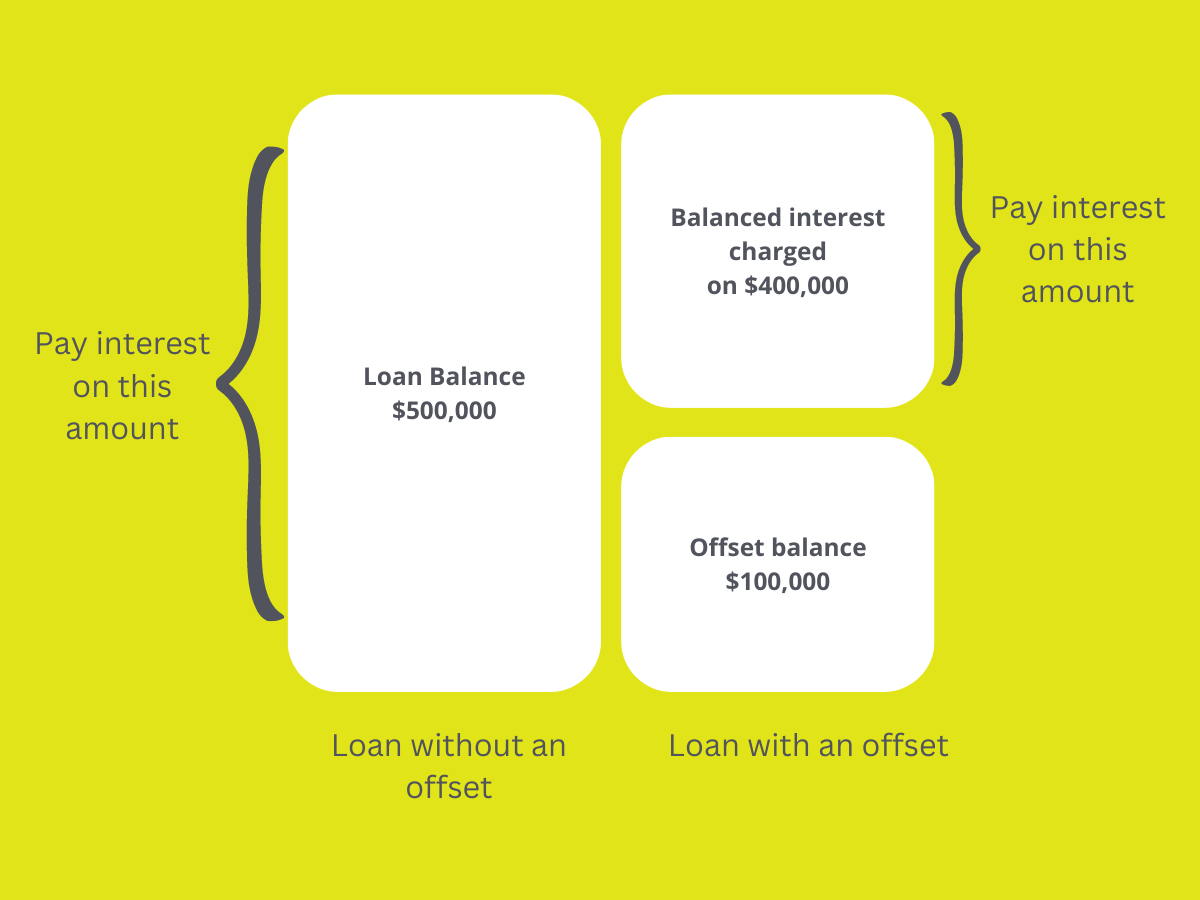

Offset Accounts

Many people have an offset account linked to there home loan however some still don’t use it to full effect. Your offset account is a normal transaction account which can help you save interest over the life of your home loan. It does not earn interest like other transactional accounts. Check out our pointers below […]

How To Manage Your Mortgage More Effectively

Managing your mortgage includes the repayments and understanding your loan conditions. To avoid costly penalties and stay on the path to paying off your home loan here are some tips that will help you manage your mortgage more effectively. 1. Set a budget.Managing your finance starts with managing your budget. Firstly, have a look at how […]

How To Prepare For A Possible Interest Rate Increase in 2022

The number one talking point in home loans today is whether the variable interest rates will rise in 2022. The Reserve Bank has confirmed they will, however there has been no indication of when in the year this will occur. So, what can you do to prepare for an interest rate rise? Firstly, you should […]

Your Investment Property Guide

Investing in property, such as residential real estate usually involves a long-term plan. You need to consider what is required before you make the purchase. To help, we’ve outlined a few things we consider important. 1. What can you afford? This is the first question you need to ask yourself. Reviewing your budget and […]