Fixed Rate Home Loan Expiring Soon?

What is a fixed rate home loan? A fixed rate home loan is an interest rate on your home loan rate for a set period of time. This means that your loan repayments will not increase or decrease if the home loan interest rate market changes. During the Covid19 pandemic and soon after, fixed rate […]

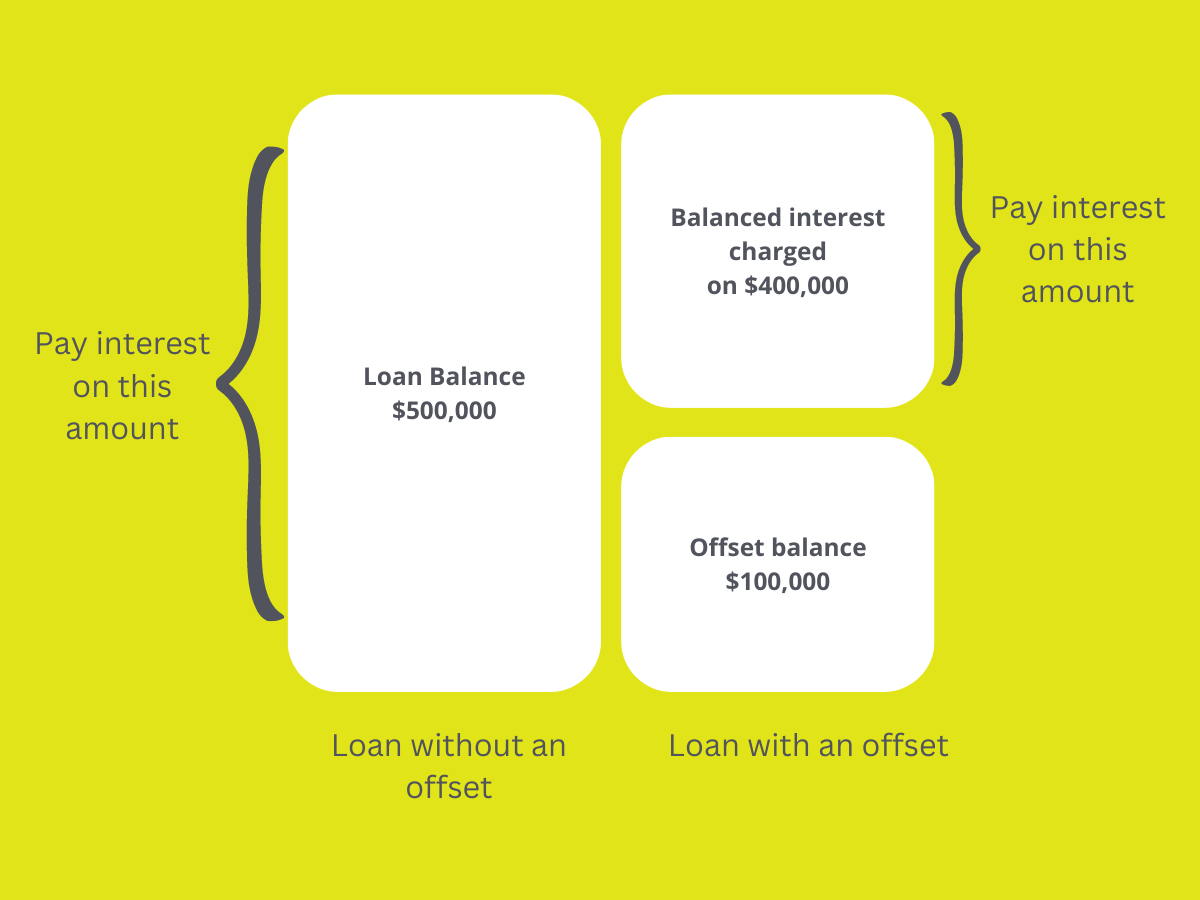

Offset Accounts

Many people have an offset account linked to there home loan however some still don’t use it to full effect. Your offset account is a normal transaction account which can help you save interest over the life of your home loan. It does not earn interest like other transactional accounts. Check out our pointers below […]

End of Financial Year – Tax Tips

Now the 2019/20 financial year has ended, it is time to get your tax returns finalised and lodged. If you are self-employed, you also need to ensure your business financials are up to date and finalised. The COVID-19 pandemic may have affected your financial situation or working arrangements, and therefore lodging your tax returns may […]

Save Money the Easy Way with a Home Loan Review

Do you know that a simple phone call or email could save you thousands of dollars on your home loan? It’s that easy, however many Australians aren’t aware of this. We often meet with clients who have been sitting on potential savings simply because they have not reviewed their home loan regularly. An increasingly competitive […]

6 Reasons Why You Should Consider a Turn-Key Home

As a first homebuyer or even second or third homebuyer, it can be overwhelming when you’re shopping for a property with so many options available. There’s the option to purchase an established home, build one, or buy a brand new property. Among the three, buying a new property, especially a turn-key property makes a lot […]